Adani Energy Solutions witnessed a substantial 11.60% surge, reaching ₹1,183.90. Following the Supreme Court’s decision not to intervene in the market regulator’s probe into allegations of stock price manipulation by the Adani Group, the shares of this power-to-ports conglomerate experienced a significant upswing.)

In what is deemed a favorable outcome for the conglomerate based in Ahmedabad, the group’s stocks soared by up to 12% on Wednesday, contributing to an overall market capitalization gain exceeding ₹15 lakh crore.

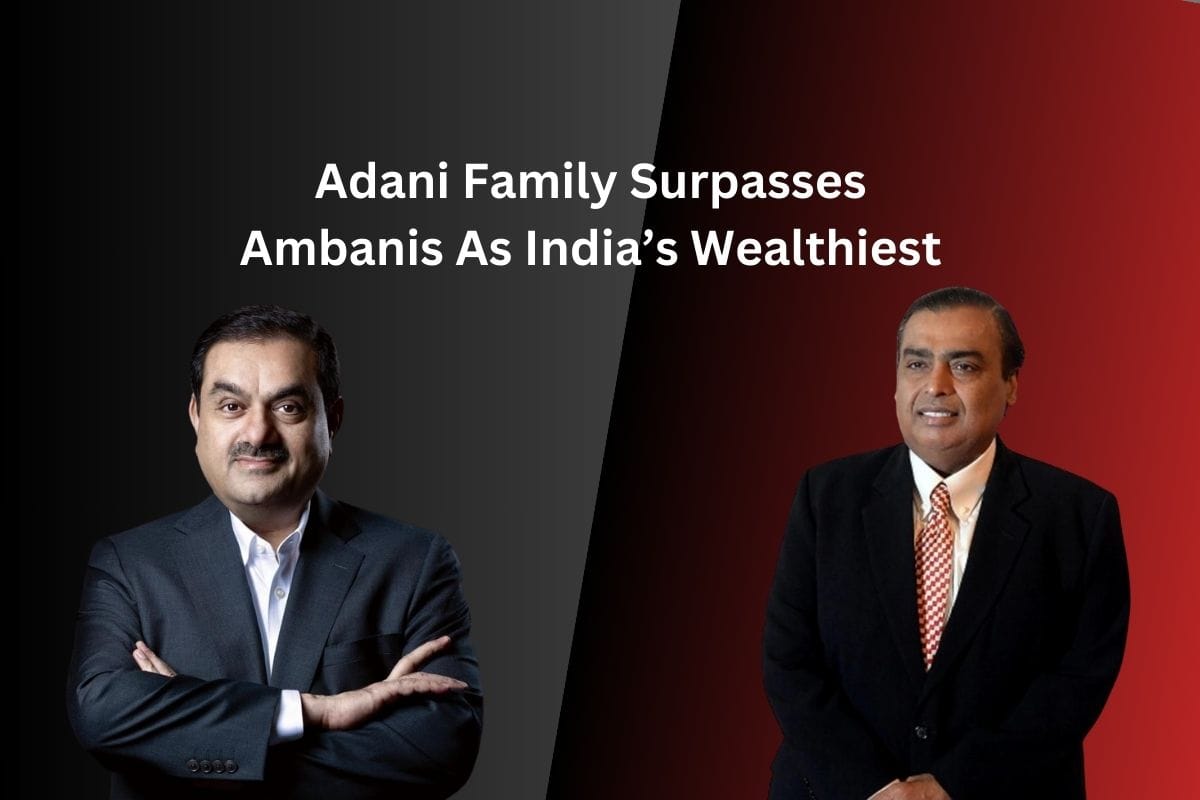

Due to these gains, the net worth of Gautam Adani’s family surpassed Mukesh Ambani of Reliance Industries, reclaiming the title of India’s wealthiest promoter, as reported by Business Standard (please note the news report is behind a paywall).

Adani Group stocks rally

• Adani Energy Solutions surged by 11.60% to reach ₹1,183.90.

• Adani Total Gas witnessed a notable increase of 9.84%, closing at ₹1,099.05.

• Adani Green Energy displayed a solid performance, climbing 6% to ₹1,698.75.

• Adani Power’s shares ended 5% higher at ₹544.65.

• Adani Wilmar experienced a gain of 3.97%, closing at ₹381.05.

• NDTV shares jumped by 3.66% to settle at ₹281.60.

• Flagship firm Adani Enterprises saw a 2.45% increase, closing at ₹3,003.95.

• Adani Ports recorded a 1.39% rise, reaching ₹1,093.50.

• Ambuja Cements shares rose by 0.94% to ₹535.60.

• ACC inched up by 0.10%, closing at ₹2,270.

Supreme Court’s judgment into Adani-Hidenburg issue

On Wednesday, the Supreme Court declined to transfer the investigation into allegations of stock price manipulation by the Indian corporate giant to a special investigation team or the CBI. The court emphasized that market regulator SEBI was conducting a “comprehensive investigation,” and its conduct “inspires confidence.”

Highlighting the limited power of the court to enter the regulatory domain of the Securities and Exchange Board of India (SEBI) in framing delegated legislation, the apex court directed SEBI to promptly conclude the two pending investigations, preferably within three months.

A bench led by Chief Justice D Y Chandrachud said that reliance on newspaper articles or reports by third-party organizations like the Organized Crime and Corruption Reporting Project (OCCRP) to question a comprehensive investigation by a specialized regulator does not inspire confidence.

The bench, also comprising Justices J B Pardiwala and Manoj Misra, acknowledged that SEBI has concluded 22 out of the 24 investigations into allegations against the Adani Group.

Leave a Reply